ACCESS TO DISTINCT TACTICS AND UNDERSTANDING FROM FAMILY MEMBERS OFFICES AND BUSINESS REALTY TO RAISE YOUR FINANCIAL INVESTMENT ABILITIES – THIS IS A CHANCE YOU DO NOT WISH TO NEGLECT!

Content Written By-Turner Enemark

Enhance your financial investment method with the advantages of household offices providing tailored techniques and specialized wealth management teams. Take advantage of business rental residential properties by tailoring lease contracts, performing marketing research, and staying adaptable with lease terms. Expand your portfolio across different properties, industries, and areas to handle threats effectively. Discover just how straightening with family offices and venturing right into business services can elevate your financial investment game and unlock new possibilities for growth and stability. Discover the possibilities these avenues use in making best use of returns and accomplishing your monetary objectives. Discover a wealth of techniques to branch out and reinforce your investment portfolio.

Advantages of Family Members Workplaces in Investments

When thinking about financial investments, household offices offer unique benefits as a result of their customized technique and long-term point of view. By working with a family members office, you can take advantage of customized financial investment methods that line up with your details monetary goals and preferences. These workplaces normally have a specialized team of specialists that focus solely on managing the riches and financial investments of the household, ensuring a high degree of experience and attention to information.

In addition, household workplaces commonly prioritize long-term growth and stability over temporary gains, enabling an extra lasting investment approach. This can be specifically advantageous when looking to construct a varied profile that can hold up against market variations and economic uncertainties. With How Family Offices Invest In Real Estate Syndication Deals investing in commercial real estate for beginners , you can also capitalize on their considerable network and access to special financial investment chances that may not be conveniently offered to individual financiers.

Maximizing Returns With Industrial Rentals

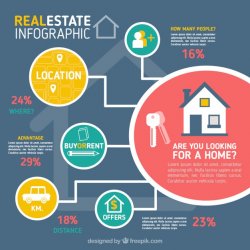

To maximize your returns with industrial leasings, take into consideration applying calculated lease contracts customized to market need and renter requirements. By customizing lease arrangements to align with the details demands of lessees and market trends, you can maximize tenancy rates and rental income.

Conduct extensive market research to understand the demands and preferences of potential renters in various industries, enabling you to tailor your offerings accordingly. Flexibility in lease terms, such as supplying much shorter lease durations or including arrangements for space adjustments, can bring in a diverse variety of tenants and improve the residential or commercial property’s appeal.

In addition, maintaining clear communication channels with occupants and without delay dealing with any type of problems or problems can foster favorable partnerships and renter retention. Providing exceptional client service and guaranteeing the residential property is well-maintained can contribute to occupant satisfaction and lasting lease contracts.

Furthermore, occasionally reviewing and changing rental prices according to market problems can assist you remain competitive and maximize your returns from business services.

Methods for Portfolio Diversification

Think about expanding your financial investment profile with a mix of property courses to alleviate danger and optimize returns. Diversification entails spreading your investments across various kinds of properties, such as supplies, bonds, property, and assets. By doing so, you can minimize the impact of market fluctuations on your total profile.

One method for portfolio diversification is to purchase both standard and alternative asset classes. Typical assets like stocks and bonds offer stability and income, while alternate possessions such as realty and exclusive equity deal possibilities for higher returns.

Another strategy is geographical diversity, where you invest in properties located in various areas or nations. This approach can help safeguard your profile from country-specific dangers and benefit from international financial development fads.

Moreover, think about diversifying across various sectors to prevent concentration threat. By buying continue reading this of fields, you can benefit from the growth of multiple industries and decrease the influence of recessions in any single market. Remember, a well-diversified portfolio can help you achieve your economic goals while handling danger properly.

Conclusion

So, why go for simply dipping your toes in the financial investment pool when you can dive in headfirst with the help of family members offices and commercial rental residential properties?

These possibilities resemble adding fuel to the fire of your profile, stiring up the capacity for rapid growth.

Do not just view your investments from the sidelines – take the jump and see your wealth soar to new heights!